What You Need to Know About Investing During an Election

Like any big news event, U.S. presidential elections can cause ripples and even waves in the stock market. In November 2016, for example, Donald Trump’s victory sent Dow Jones Industrial Average futures plunging 900 points on election night, as investors reacted to the unexpected outcome. The next day, markets shot back up, rallying sharply. That […]

End-of-Summer Market Update

Speed bump, stop sign, or red light? That’s the question investors are asking. Let me explain. After cruising for the past five months, the markets screeched to a halt on September 3rd. The Dow dropped over 800 points, and the Nasdaq plunged nearly 5%. All told, it was one of the worst trading days for […]

Who Will Be the Next President of the United States?

It’s probably no surprise that investors favor push and pull in Washington D.C. rather than one party writing and approving the laws, as the tension limits market uncertainty in terms of legislative risk. Some of the best stock market years occurred during a split Congress. The stock market gained more than 30% in 1985, 2013, […]

Making Sense of the 2020 Oil Crash

How can something cost less than $0? That’s the question many people have been asking this week. It all started on Monday, April 20, when headlines like this dominated the news: U.S. Oil Prices Fall Below Zero For the First Time in History1 That same day, plummeting oil took the stock market down with it […]

5 Tips for Navigating the Coronavirus Crash

When stock markets experience sudden downturns, investors can feel anxious and make decisions detrimental to their long-term goals. After all, when you’ve worked hard for the money, it’s painful to see your account balances drop. This is a natural reaction, even with savvy investors who’ve experienced market volatility before. These extremes are enough to test […]

Coronavirus Market Recap

After hitting a low of 18,591 on March 231, the Dow has climbed over 25% since then. (As of this writing, the Dow sits at 23,650.2) In my opinion, that means the brief-but-vicious bear market we endured in March is over. So, does that mean the recent volatility is over, too? To answer that, let’s […]

Breaking Down the Cares Act

As you know, the coronavirus pandemic has created both a health crisis and an economic crisis. As of this writing, there are over 160,000 knowncases.1 By the time you read this, there will certainly be more – and that number does not reflect those who have been infected but not tested. The economic cost, meanwhile, has resulted […]

Four things others will wish they had done – that we’re already doing!

As you know, the coronavirus situation continues to hammer the markets. All over the world, investors large and small are facing a level of uncertainty we haven’t experienced in over a decade. But I’m proud to say that, based on the conversations I’ve had with you and my other clients, there may be no group […]

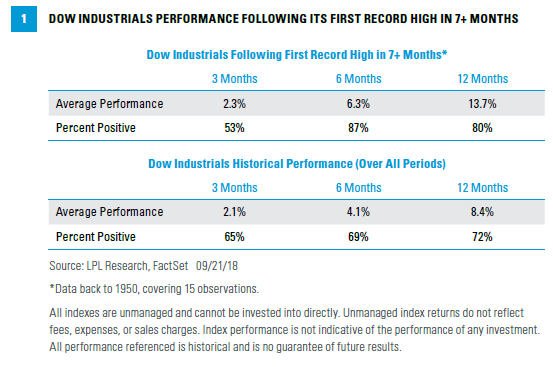

NEW HIGHS TEND TO PRECEDE MORE NEW HIGHS

The Dow joined the S&P 500 in reaching fresh new highs last week. The record came after a drought lasting nearly eight months. The blue chip index has lagged the S&P 500 Index and Nasdaq Composite this year amid escalating trade tensions, which have weighed on the larger multinational U.S. companies that make up most of the 30-stock Dow Jones […]