Our Process

Introduction & Discovery

Data Gathering

Your Financial Blueprint

Matching Investment Risk to Your Financial Blueprint

Introduction & Discovery

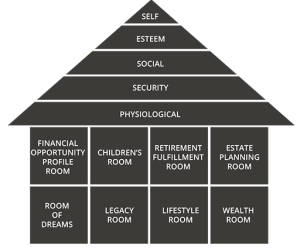

Your Financial House

If you’ve ever built a house or known somebody who has, you know there was a vision of what it would look like long before it was constructed. If you told the builder, “Listen, we’ve taken pictures off the internet,sketched out some designs and this is how wethink the house should look. We really don’t want to do a blueprint… just start building.” The builder would never take that job.

Sadly in the financial service industry, you can meet with a financial advisor, share your vision, thoughts and financial statements only to watch the advisor jot down a few notes and say, “Now that I have a glimpse of your vision, let’s take your money and place them in “these investments” which have historically done well.”

This is the equivalent of a builder who would take your money and start building your house without a blueprint. You would never build a house without a blueprint. Why would you do the same with your financial future? You need a financial blueprint to build Your Financial House

Life Insurance Planning

Okay, we know this isn’t a fun topic to discuss. However, we know, life doesn’t guarantee us tomorrow. We value helping you determine how much or how little life insurance you need depending on your circumstances and stage of life.

You buy life insurance not because you’re going to die, but because those you love are going to live—and you want them to be financially secure after you’re gone.

Long Term Care Insurance Planning

Let’s face it—the discussion that our health may one day decline to a point where we need help in the home, move into an assisted living community or live our final days in a nursing home isn’t an enjoyable topic. The reality, however, is we need to prepare in case it does.

The cost of care can potentially eat up your entire life’s savings.

Purchasing long-term care insurance can help you have peace of mind. You’ll know that if you become ill, you can afford the care you need and still have enough money for you and your spouse to eat. Plus, your children won’t be burdened with huge payments for your care.

We value helping you plan for this unforeseen event so you can afford the absolute best care and circumstances should a long-term care need arise in your lifetime.

Investing

Investment Management

The Power of Fiduciary Advice

Fee-based Advice

Building Your Portfolio

We use a repeatable, thoughtful process to determine the right strategy for you and your objectives.

1. Clarify your goals and timeline

The first step in building your portfolio strategy is determining your financial goas and when you want to accomplish them. We will sit down with you to clarify what you hope to achieve from your investments, whether that’s planning for retirement, income generation during retirement, estate planning for the next generation, charitable giving, saving for a child’s college education, working toward a larger purchase and more. Together, we’ll establish goals that will guide our strategy decisions.

2. Determine your risk tolerance

Once we know what you hope to accomplish, the next step is figuring out how you feel about investing. We will spend time working with you to determine if you prefer a more conservative or aggressive approach, or somewhere in between.

3. Identify an investment style

Next, we will work with you to determine which investment style is best for your specific goals and current market conditions. The two primary investment-style options are strategic and tactical.

Strategic investing allows you to stay full invested in a steady asset allocation model using a traditional buy-and-hold investment philosophy. Your asset allocation would be based on our market research long-term outlook and wouldn’t change much due to market fluctuations.

Tactical investing attempts to take advantage of short-term market fluctuations to find opportunities for larger gains. In this case, your asset allocation would be based on a shorter time frame and change more often as a result of the market’s movements. Because more trading occurs in tactical investing, we’d have to consider the tax impact of this type of strategy. There’s a wide variety of tactical investment management styles, which we’ll discuss when it’s time to look at the models best suited for you.

We can also choose to combine strategies and tactical models if it makes sense for you and your objectives.

4. Select your investment theme

The last major piece of the portfolio puzzle is your investment theme, which is the overall objective your portfolio will drive toward. Your goals, risk tolerance and preferred investment style will help our firm’s advisors determine the best theme for your portfolio.

The following are a few examples of our investment themes:

Core Strategies are for client’s whose focus is to accumulate assets over time to meet a specific goal. For example, to save for retirement, send a child to college, acquire a home, etc.

Income Generation Strategies are for clients whose primary objective is to withdraw assets from their portfolio to manage current expenses without depleting their initial investment. For example, to support your current living requirements.

Risk Aware Strategies are for clients whose primary objective is the preservation of their accumulated assets. For example, if you get nervous about market volatility or would prefer to preserve what you have, rather than seeking higher returns.

Complementary Strategies are for rounding out and supplementing your portfolio. For example, if we determine you need strategies to dial down or dial up the risk in your portfolio.

5. Implement your portfolio

Once we’re ready to bring your portfolio to life, we’ll discuss your expectations and review what we want to accomplish through your customized strategy. To get your portfolio up and running, we’ll:

- Transition your existing securities

- Determine the type of account ownership and beneficiaries

- Discuss the source of funds

- Complete and sign all paperwork

6. Review and manage your portfolio

Once your investments are in place, we’ll continue to review and manage your portfolio on an ongoing basis. The ongoing management of your portfolio will include:

- Regular meetings and discussions so you can feel comfortable with your continued strategy

- Active, ongoing portfolio reviews

- Periodic reexamination of your investment strategy to make sure it continues to stay aligned with your situation and objectives

- Rebalancing decisions to ensure the allocation of your assets remains in line with your stated investment objectives

- Monthly statements including annual advisory account performance along with the access to track your account(s) at any time via website and app.

Straightforward Fees

You should know what you’re paying your advisor and how we apply those fees to your investments. We’ll explain our fee structure so you have confidence that you’re receiving value from your advisor.

The problem with commissions? They have a way of interfering with sound recommendations. Instead, we are fee-based in order to be the very best steward of your financial future, as well as operating as licensed fiduciaries.

We don’t work on commissions. Instead, we earn our pay through insight and prudence, not churning sales. We stake our growth on your growth, on your performance year after year. So, our clients see us as their long-term partner.

You succeed—we succeed.